With the report series “Next Generation – Startups in Germany”, the Startup Association and startupdetector record the dynamics of startups in Germany. One observation is that significantly more startups per capita are founded in Hamburg and Berlin than in the other federal states – in absolute figures, 27% of startups were founded there in the first half of the year.

The core results:

(1) More start-ups founded:

Compared to the second half of 2022, startup founding activity in Germany increased by 16% to just under 1,300 startups in the first six months of 2023.

(2) Signs of a trend reversal:

A particularly high number of start-ups were founded in June 2023, which is the first sign of a return to the positive momentum of previous years following the slump in start-ups in 2022.

(3) Berlin up significantly, Hamburg too:

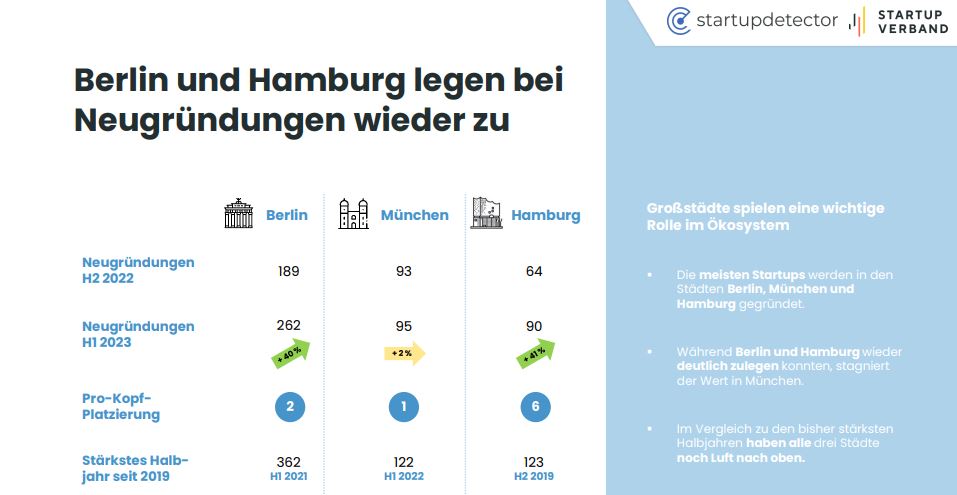

After the massive slump in startups in the startup hotspot Berlin last year, the capital is back with a strong increase of 40 percent – the Hanseatic city of Hamburg even with 41 percent – Munich is currently stagnating, but remains at the top in terms of startups per capita over the past 12 months. In Berlin and Hamburg, significantly more startups are founded per capita than in the other federal states – in absolute figures, 27% of startups were founded here in the first half of the year.

(4) Tourism winners – blockchain/crypto losers:

Overall, there is an upward trend in almost all sectors – the clear winner is tourism (+ 111%), the clear loser is blockchain & crypto (- 62%).

The ongoing economic uncertainties led to a slump in start-ups last year. This downward trend has been halted with an increase of 16% in the first half of 2023 – the development in recent months has been particularly positive. At the same time, the number of start-ups in the first half of 2023 is significantly lower than in the record year 2021.

The regional distribution shows that the Berlin ecosystem has recovered after the significant slump in 2022. Although Munich remains close to the top in terms of population, the positive trend of most other regions cannot be seen here. It is worth noting that three research-related start-up locations – Karlsruhe, Darmstadt and Heidelberg – are among the top 5 in the ranking of start-ups per capita. This shows the great potential of the strong research here for start-up activity.

The general upturn in start-ups is evident in almost all sectors. However, the blockchain and crypto sector is showing a clearly negative trend, reflecting the current crisis in the industry. The tourism industry is the clear winner (+111%), with the mobility (+30%), food (+29%) and software (+23%) sectors also recording the strongest growth.

The full report can be downloaded here can be downloaded here.

Christian Miele (Chairman of the Startup Association):

“Significantly more start-ups were founded again in the first half of 2023. After the slump in start-ups in 2022, this is an important signal for the economic and innovative strength of our country.

This dynamic is not a sure-fire success; we must do all we can to keep it alive. We are calling on the federal government to implement the measures of the startup strategy, which will soon be in its sixth year, swiftly and decisively. There is still room for improvement here. If we make Germany the global market leader for start-ups, this could give our sluggish economy a real boost.

The high start-up dynamics at research-intensive locations show what potential Germany has beyond the well-known start-up hotspots. In order to make better use of our strength in research, we need to raise the profile of entrepreneurship at universities and lower the legal and bureaucratic hurdles for spin-offs. If this succeeds, we will see many more start-ups at German universities.”

Dr. Felix Engelmann (co-founder of startupdetector):

“Last year, we experienced a historic decline in the number of start-ups. It is to be hoped that the start-up scene will emerge from this crisis similarly strengthened as it did from the coronavirus pandemic. Just like back then, certain sectors are now proving to be crisis-proof or even crisis winners. During the pandemic, new ideas in e-commerce flourished, last year green technologies bucked the negative trend and now potential is emerging in the tourism and mobility sectors.

This is the strength of start-ups: with agility and courage, they focus their innovative power on the opportunities that can be found in every crisis. This is why startup funding is of great importance for Germany as a location for innovation.”

About the report:

The report “Next Generation – Startups in Germany” provides continuous, semi-annual monitoring of one of the key success indicators of the German startup ecosystem. The series is based on data collected by startupdetector on startups founded in Germany based on commercial register data, which has been collected since 2019.

About the Startup Association

Since its foundation in 2012, the association has represented the interests of startups in politics, business and the public. In its network, which now has over 1,100 members, the association also aims to promote exchange between startups, but also between startups and the established economy.